The fintech ecosystem in Brunei Darussalam has made significant strides in the last few years.

With the government steadfast in advancing the nation’s digital economy and the pandemic accelerating the application of digital technologies and increasing the demand for fintech services, the sultanate is primed towards its goal of becoming a Smart Nation.

One of the key players at the frontlines of this nationwide fintech vigour is Jana Kapital, Brunei Darussalam’s pioneer Syariah-compliant peer-to-peer (P2P) crowdfunding platform, which provides alternative financing for MSMEs and investment opportunities for the general public.

Crowdfunding is the process of raising capital for a project, business or charitable cause through a pool of contributors via the internet and is considered an alternative form of fund raising solution compared to the traditional bank methods.

For Jana Kapital in particular, which is a crowdfunding concept that is premised on Islamic finance structures, contributions from investors or crowd-funders will be used in the acquisition of assets that are necessary for the listed MSME to grow, based on a risk-sharing principle.

In an interview with The Bruneian, Managing Director Hj Aidil Salleh shared the significance of having a homegrown crowdfunding platform; what it spells for financial inclusion among MSMEs and how the general public can have their finger on the pulse of the local economy.

Creating an impact through crowdfunding

“One of the key reasons, why we went about this journey (establishing Jana Kapital) is the realisation that startups and MSMEs generally face difficulty in trying to raise capital and growing their business,” he explained.

“For most of them, acquiring funds through traditional bank methods may not be an option, especially with the high requirements that have been set, in terms of the collateral and track record,” he added.

“What we are really trying to do is to give these new entrepreneurs the ability execute their business ideas, to expand and commercialise by giving them the opportunity to raise capital from the general public,” the managing director continued.

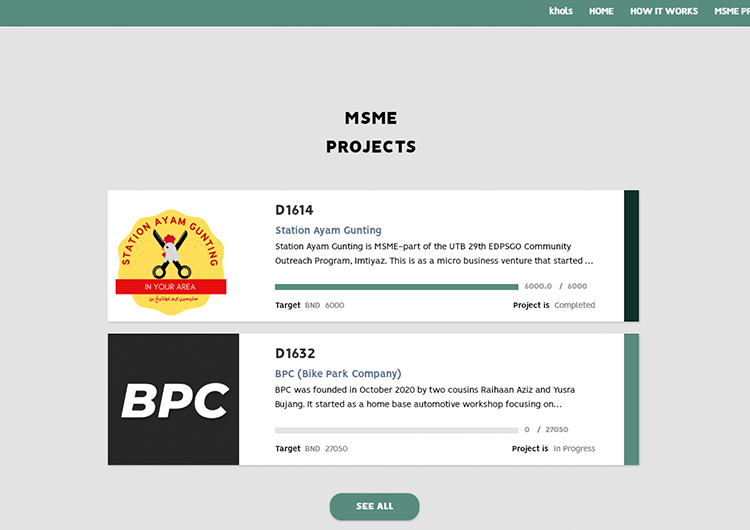

Since its launch in November last year, Jana Kapital has listed about six MSMEs on the platform, however, only one campaign has been successful, which allowed food vendor Station Ayam Gunting (SAG) to acquire a modified shipping container to expand its operations.

“For SAG, the campaign period lasted over a month, however, the amount of investment needed, – which was $6,000 – was fully crowdfunded well before the campaign period was over,” he shared, adding that the whole process from being listed to the acquisition of the asset took over a month and a half.

“We are delighted to see how much the business has grown, and the impact that the crowdfunding campaign made in terms of how the owners are able to run their business. Lately, they have been trying to expand their business more to allow customer dine-ins,” he added.

Ease of investing and worthwhile returns

Part of the reason why Jana Kapital was established was to ensure financial inclusion, particularly for MSMEs and startups, however, the other side of this coin is to open up investment opportunities to the general public.

“Through Jana Kapital, there is an opportunity for our general investors to affordably participate in our crowdfunding platform, as the minimum amount of investment is only $50,” Hj Aidil.

He added that Jana Kapital offers full transparency to its investors, while also providing a “new investment experience” for the Bruneian market, allowing members of the general public to support commercially-viable MSME projects “that drive the real economy sector” in the country.

“It is very important for the general public that there are these profitable MSME projects that are available in our home ground that they can take part in, which should provide some comfort and ease of mind, knowing that their investment will help drive and grow the local economy,” he added.

Apart from this, the managing director also emphasised better returns of investments (ROI) for investors who participate in the Islamic crowdfunding platform. Using the SAG campaign as an example, Hj Aidil explained that investors of the campaign can enjoy a 6% ROI after a certain period.

“For this particular campaign, after performing our due diligence and looking at their cashflow, the business is able to generate a 6% ROI after 18 months, and that payout is expected to occur next year in June,” he said.

“Let’s say for this campaign, you invested $1,000. So at 6% ROI, the investor is expected to receive $60 after 18 months on top of the initial amount invested,” he explained further adding that these kinds of returns are more gainful than those you may receive from a normal savings account.

Calling for more crowd-funders

Despite a successful campaign, and a new MSME being listed on the platform, Hj Aidil noted that public participation on the crowdfunding platform leaves a lot to be desired.

“Crowdfunding is still a very nascent market in Brunei, so there still needs to be an extensive level of socialization on the subject not only from our part but also the stakeholders involved,” he said.

“People need to understand that there are other debt financing solutions available in the marketplace apart from banks, and we try to do that by engaging the grassroots section of the society like students,” he added.

Ultimately, Hj Aidil acknowledged that it may be a long road ahead to fully familiarize the Bruneian market with the concept of crowdfunding, but wanted to assure those that are interested in participating that Jana Kapital as a platform is secure.

The crowdfunding platform is not only fully Syariah-compliant but is also governed by the Brunei Darussalam Central Bank (BDCB) under the Peer to Peer (P2P) Financing Platform Operators.

“We’ve gone through ups and downs after our launch, but we are very positive about our cause and we want to continue our journey,” he added.

“We hope to not only have the support of the general public in growing the local economy by participating on our platform but we also welcome collaborations with other stakeholders like financial institutions,” he continued.

“We have to work together to make fintech successful in Brunei Darussalam, and crowdfunding is just one aspect of it,” Hj Aidil went on to say.

For those interested in Jana Kapital, you can visit their website at www.janakapital.com

THE BRUNEIAN | BANDAR SERI BEGAWAN